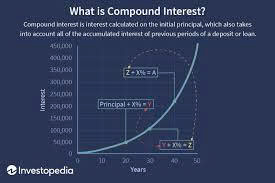

Compound interest is one of the most powerful concepts in personal finance — and also one of the most misunderstood. Simply put, it’s the reason money can grow faster over time, or why debt can spiral out of control if you’re not careful.

Whether you’re saving for the future or paying off a credit card, understanding compound interest can help you make smarter money decisions.

What Does Compound Interest Mean?

Compound interest means you earn (or pay) interest not only on your original amount of money, but also on the interest that’s already been added.

In other words, it’s interest on top of interest.

Here’s a simple way to think about it:

-

With simple interest, interest is calculated only on the original amount.

-

With compound interest, interest keeps stacking — each period builds on the last.

Over time, this creates a snowball effect.

Why Compound Interest Matters So Much

Time is the secret ingredient that makes compound interest so powerful.

The longer your money has to grow, the more dramatic the results become. Even small amounts can turn into large balances if given enough time.

This works in two very different ways:

-

Great for savings and investing

-

Dangerous for debt

That’s why compound interest is often called both your best friend and your worst enemy in personal finance.

How Compound Interest Works (Without the Math Headache)

You don’t need to memorize formulas to understand compound interest.

What matters most are three things:

-

Your starting amount

-

The interest rate

-

How often interest is added

Every time interest is added to your balance, your new total becomes the base for the next round of interest.

Example:

If you save $1,000 and earn interest, the interest gets added to your balance. Next time, interest is calculated on the larger amount — not just the original $1,000.

That cycle repeats again and again.

A Simple Real-Life Example

Let’s say you put $10,000 into an account earning 5% interest per year.

-

After year one, you earn interest on $10,000

-

After year two, you earn interest on $10,000 plus the interest from year one

-

After year three, you earn interest on an even larger balance

By the end of three years, you’ve earned more than you would with simple interest — even though the rate never changed.

That’s the power of compounding.

The Rule of 72: A Quick Trick

Want a fast way to estimate how long it takes your money to double?

Use the Rule of 72:

-

Divide 72 by your annual interest rate

Example:

If your money earns 4% per year:

-

72 ÷ 4 = 18

Your money will roughly double in 18 years.

It’s not exact, but it’s a handy shortcut.

Why Starting Early Is So Important

Compound interest rewards patience.

Starting just a few years earlier can make a massive difference — even if you save less money overall.

Example:

Someone who starts saving a small amount in their 20s can end up with more money than someone who saves much larger amounts starting in their 40s.

Why?

Because the early saver gives compound interest more time to work.

This is why financial experts always stress:

Start early. Be consistent. Let time do the heavy lifting.

How Often Interest Is Compounded

Interest can be added:

-

Yearly

-

Monthly

-

Daily

-

Or even continuously

The more often interest is added, the faster your balance grows (or your debt increases).

Here’s how compounding typically works in real life:

-

Savings accounts: often compounded daily

-

Certificates of deposit (CDs): daily or monthly

-

Loans: usually monthly

-

Credit cards: often compounded daily

Frequent compounding benefits savers — but hurts borrowers.

Compound Interest and Debt: The Dark Side

Compound interest doesn’t care whether it’s helping or hurting you.

With high-interest debt, especially credit cards, compounding can cause balances to grow fast if you only make minimum payments.

Example:

When you pay only the minimum on a credit card, interest keeps building on your remaining balance — and then earns interest again.

This is how people get stuck in long-term debt cycles.

The takeaway:

-

Pay more than the minimum whenever possible

-

Prioritize high-interest debt first

Pros and Cons of Compound Interest

Pros

-

Helps money grow faster over time

-

Makes long-term investing more powerful

-

Helps fight inflation by increasing purchasing power

Cons

-

Can rapidly increase debt balances

-

Investment earnings may be taxable

-

Harder to calculate without tools

Compound Interest in Investing

Compound interest plays a major role in investing, especially when earnings are reinvested.

Examples include:

-

Reinvesting dividends from stocks or mutual funds

-

Retirement accounts like IRAs and 401(k)s

-

Zero-coupon bonds that grow in value over time

When earnings stay invested, they generate more earnings — creating long-term growth.

Tools to Calculate Compound Interest

You don’t need advanced math skills to use compound interest wisely.

Helpful tools include:

-

Online compound interest calculators

-

Spreadsheet tools like Excel

-

Retirement planning calculators

These tools let you see how different interest rates, time periods, and monthly contributions affect your money.

How to Know If Interest Is Compounded

Lenders are required to disclose whether interest is compounded and how often it’s added.

Always review:

-

Loan terms

-

Credit card disclosures

-

Account details

Knowing how interest works helps you avoid surprises.

The Bottom Line

Compound interest is one of the most important money concepts to understand.

Over time, it can:

-

Turn small savings into significant wealth

-

Make early investing incredibly powerful

-

Cause debt to grow quickly if ignored

The key is learning how to make compound interest work for you, not against you.

Start early, stay consistent, and pay attention to interest rates and compounding frequency. When used wisely, compound interest can be one of your strongest tools for building long-term financial security.