If you’ve ever paid a bill online, received your paycheck by direct deposit, or sent money to someone digitally, you’ve already used an electronic money transfer — even if you didn’t realize it.

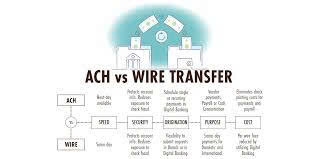

Two of the most common ways banks move money electronically are ACH transfers and wire transfers. While they might sound similar, they work very differently, especially when it comes to speed, cost, and when you should use each one.

Let’s break it down in plain English.

What Is an ACH Transfer?

An ACH transfer is a way to move money between banks using the Automated Clearing House network. This system processes huge numbers of payments in batches rather than sending money instantly.

ACH transfers are commonly used for everyday money tasks, such as:

-

Getting paid by direct deposit

-

Paying utility bills or credit card bills

-

Sending money through apps like Zelle

-

Transferring money between your own bank accounts

Because ACH transfers are processed in groups, they usually take one to three business days to complete.

How ACH Transfers Work (Simply Explained)

There are two basic types of ACH transfers:

-

ACH credit: Money is sent to an account

-

Example: Your employer deposits your paycheck into your bank account.

-

-

ACH debit: Money is pulled from an account

-

Example: Your phone bill is automatically paid from your checking account.

-

Most consumers can set up ACH transfers online or through their bank’s mobile app.

ACH Transfer Costs

For consumers, ACH transfers are usually free or very low-cost. While banks pay small processing fees behind the scenes, many don’t pass those costs on to customers.

That’s why ACH is the go-to option for regular payments and routine transfers.

Real-Life ACH Example

You’re paying rent online, your paycheck hits your account every two weeks, and you send your sister $50 using Zelle — all of those typically rely on ACH transfers.

What Is a Wire Transfer?

A wire transfer moves money directly from one bank to another without going through a batch processing system. Because of this, wire transfers are much faster — often arriving the same day.

People usually choose wire transfers when speed and certainty matter more than cost.

Wire transfers are often used for:

-

Home down payments

-

Large business transactions

-

International money transfers

-

Time-sensitive payments

How Wire Transfers Work

To send a wire transfer, you usually need detailed information, including:

-

The recipient’s full name

-

Their bank account number

-

Their bank’s routing number (or SWIFT code for international transfers)

Once submitted, the money typically arrives the same day for domestic wires, as long as you meet the bank’s cutoff time.

International wire transfers can take a few business days.

Wire Transfer Fees

Wire transfers are significantly more expensive than ACH transfers. Typical fees include:

-

Domestic outgoing wire: $20–$35

-

International outgoing wire: $35–$50

-

Incoming wire: Sometimes free, sometimes up to $25

-

Currency exchange fees: Vary by bank

Because of these costs, wire transfers are best reserved for situations where timing really matters.

Real-Life Wire Transfer Example

You’re buying a home and need to send a $40,000 down payment by a specific deadline. A wire transfer ensures the money arrives quickly and securely.

ACH vs. Wire Transfer: What’s the Difference?

Both methods move money electronically, but they serve different purposes.

ACH transfers are ideal for everyday transactions. They’re slower but affordable and flexible.

Wire transfers are built for urgency and large sums, but they come with higher fees and fewer protections if something goes wrong.

Key Differences at a Glance

-

Speed

-

ACH: 1–3 business days

-

Wire: Same day or next business day

-

-

Cost

-

ACH: Usually free

-

Wire: Can cost up to $50 per transfer

-

-

Best for

-

ACH: Bills, paychecks, app payments

-

Wire: Home purchases, large urgent payments

-

-

Reversibility

-

ACH: Sometimes reversible

-

Wire: Usually final once sent

-

-

Fraud risk

-

ACH: Lower risk, more time to catch errors

-

Wire: Common target for scams due to speed

-

Common Questions About ACH and Wire Transfers

Are ACH Transfers Only for the U.S.?

ACH is mainly used within the U.S., but international ACH transfers do exist. That said, many people use wire transfers or money apps for sending money abroad.

Is Zelle an ACH Transfer?

Yes. Zelle moves money using the ACH network, even though it feels instant to users.

Which Is More Secure?

ACH transfers are often considered safer for consumers because they’re regulated, slower, and sometimes reversible. Wire transfers are secure technically, but once the money is sent, it’s very hard to get back if there’s a mistake or scam.

The Bottom Line

Both ACH transfers and wire transfers play important roles in modern banking.

-

Use ACH transfers for everyday money needs like paying bills, getting paid, and sending money through apps.

-

Use wire transfers when you need to move a large amount of money quickly and on a tight deadline.

Knowing the difference can help you avoid unnecessary fees, reduce risk, and choose the smartest option for your situation — especially when real money is on the line.