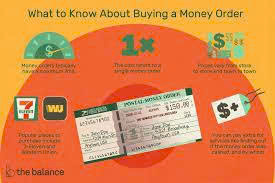

A money order is a prepaid paper payment that works like a guaranteed check. You buy it for a specific amount, and the person you give it to can cash it or deposit it into their bank account. Because the money is paid upfront, a money order cannot bounce the way a personal check can.

Money orders are commonly used when cash feels unsafe or when someone doesn’t have a checking account. They’ve been around for a long time and are still widely accepted for things like rent, bills, and mailed payments.

Why People Use Money Orders

Money orders are popular because they’re secure, simple, and widely accepted. You don’t need a bank account to buy one, and you don’t share personal banking information with the person receiving it.

For example, if your landlord doesn’t accept online payments or personal checks, a money order is often an easy solution. It’s safer than sending cash through the mail and more reliable than a personal check.

How a Money Order Works

When you buy a money order, you choose the amount you want to send and write in the name of the person or business receiving it. Most U.S. money orders have a maximum limit of $1,000, so larger payments may require more than one.

You’ll also receive a receipt with a tracking number. This receipt is extremely important—it’s your proof of purchase and the only way to trace or replace the money order if it gets lost or stolen.

Real-Life Example

If you need to mail a $600 rent payment, you can buy a $600 money order, write your landlord’s name on it, and mail it. Your landlord can then deposit it just like a check.

Where You Can Buy a Money Order

Money orders are easy to find. You can buy them at:

-

Banks and credit unions

-

U.S. Post Offices

-

Grocery stores and convenience stores

-

Retailers that offer money services (like Western Union or MoneyGram)

You usually pay with cash or a debit card, plus a small service fee.

How Much Does a Money Order Cost?

Money order fees are generally low, especially compared to other payment options. The fee depends on where you buy it and the amount.

In many cases, the cost is just a few dollars. International money orders typically cost more than domestic ones.

Pros and Cons of Using Money Orders

Advantages

No personal bank details

Unlike personal checks, money orders don’t include your bank account or routing numbers, reducing the risk of fraud.

Easy for recipients to use

The person receiving a money order can cash it at a bank, credit union, or certain retail locations—or deposit it into their account.

Works without a bank account

Money orders are a great option for people who don’t have checking accounts or prefer not to use digital payments.

Useful for international payments

Some money orders can be issued in one country and cashed in another, making them a simple way to send money abroad.

Disadvantages

Harder to track than checks

If you lose your receipt, tracking a money order can be difficult or impossible.

Fees apply

You may pay a fee to buy the money order and another fee if the recipient cashes it somewhere other than a bank.

Possible delays

If a money order is deposited rather than cashed, the funds may be held for a short period.

Risk of fraud

Fake money orders do exist, so it’s important to be cautious when receiving one from someone you don’t know.

How to Fill Out a Money Order Correctly

To avoid problems, always fill out a money order carefully:

-

Write the recipient’s name in the “Pay to” line

-

Fill in your name and address (if required)

-

Enter the payment amount

-

Sign and date the money order

-

Keep the receipt in a safe place

Once written, money orders usually cannot be changed or canceled easily.

Where Can You Cash a Money Order?

Money orders can usually be cashed at:

-

Banks or credit unions

-

Post offices

-

Check-cashing stores

-

Some grocery or convenience stores

Cashing may involve a small fee. To avoid fees, depositing the money order into your bank account is often the best option.

Do Money Orders Expire?

Most money orders do not expire, but some issuers may charge fees if they aren’t cashed after a long period of time. These details are printed on the back of the money order.

U.S. Postal Service money orders never expire and never lose their value.

Money Orders vs. Cashier’s Checks

Both money orders and cashier’s checks are secure payment options, but they serve different purposes.

-

Money orders are best for smaller payments (usually under $1,000)

-

Cashier’s checks are used for large purchases, like buying a car or home

Cashier’s checks are issued directly by banks and are generally considered more secure for large transactions.

The Bottom Line

A money order is a simple, reliable way to send or receive money—especially when cash, checks, or online payments aren’t an option. They’re easy to buy, widely accepted, and safer than sending cash through the mail.

However, money orders do come with fees and require careful handling. Always keep your receipt, fill them out correctly, and be cautious when receiving one from someone you don’t know.

For many everyday payments, money orders remain a practical and trusted financial tool.